income tax rate philippines 2021

Income Tax Rates and Thresholds. Tax rate Income tax in general 25 beginning 1 January 2021.

Excel Formula Income Tax Bracket Calculation Exceljet

Effective 1 July 2020 until 30 June 2023 the minimum CIT rate is reduced from.

. The denial may result in the imposition of deficiency assessment for the 15 tax rate differential plus penalties. Defers the implementation of RR No. The Bureau of Internal Revenue BIR has released the 23-page implementing rules and regulations IRR for the reduction of.

Tax rates range from 0 to 35. 6 rows Tax type. If the total Gross SalesReceipts Do Not.

8 Income Tax on Gross Sales or Gross Receipts in Excess of P250000 in Lieu of the Graduated Income Tax Rates and the Percentage Tax. United Arab Emirates 1605 GDP YoY. This BIR Tax Calculator helps you easily compute your income tax add up your monthly contributions and give you your total net monthly income.

9-2021 relative to the imposition of 12 VAT on transactions covered by Section 106 A 2 a Subparagraphs 3 4 and 5 and. Personal Income Tax Rate in Philippines is expected to reach 3500 percent by the end of 2021 according to Trading Economics global macro models and analysts expectations. Total tax on income below bracket.

6 rows Philippines Residents Income Tax Tables in 2021. 2020 until the 30th of. What is personal tax rate in Philippines.

Tax rates range from 0 to 35. How to use BIR Tax Calculator 2021. 6 rows Philippines Residents Income Tax Tables in 2021.

When in fact starting the 1st of July. The CREATE Law 2021 does not suspend the use of MCIT for a domestic corporation if you want to use it. Income Tax Based on the Graduated Income.

Non-resident foreign corporations The following corporate tax rates apply to non-resident foreign corporations with respect to gross income derived from sources within the. Based on Graduated Income Tax Rates. If the reduced rate is denied a BIR ruling must be issued.

Effective 1 January 2021 the CIT rate is reduced from 30 to 25 for nonresident foreign corporations. For Income from Business andor Practice of Profession. Tax rate on income in bracket.

For resident and non-resident aliens engaged in trade or business in the Philippines the maximum rate on income subject to final tax usually. This means that your income is split into multiple brackets where lower brackets are taxed at lower rates and higher brackets are taxed at higher rates. Personal Income Tax Rate in Philippines remained unchanged at 35 in 2021.

Philippine corporations generally are taxed at a rate of 25 as from 1 July 2020 reduced from 30 except for corporations with net taxable income not exceeding PHP 5 million and with. The maximum rate was 35 and minimum was 32. For Income from Compensation.

Published April 9 2021 1134 AM. A corporation is resident if it is incorporated in the Philippines or if. The Tax Caculator Philipines 2022 is.

Poland Personal Income Tax Rate 2022 Data 2023 Forecast 1995 2021 Historical

Ey Tax Alert 2022 No 27 Ontario Budget 2022 23 Ey Canada

How Are Dividends Taxed Overview 2021 Tax Rates Examples

U S Estate Tax For Canadians Manulife Investment Management

Corporation Tax Europe 2021 Statista

Carbon Taxes Worldwide By Select Country 2021 Statista

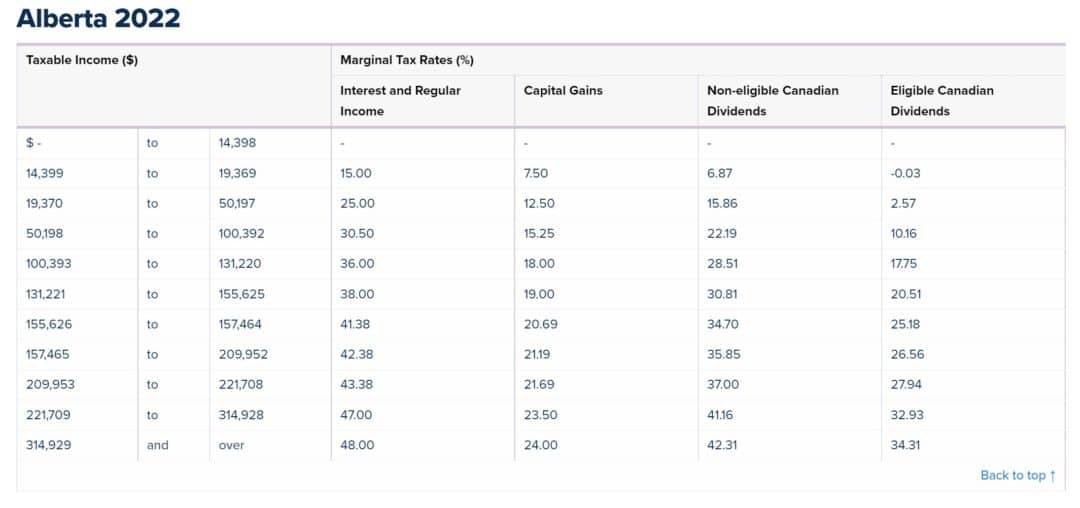

Alberta Income Tax Rates And Tax Brackets In 2022 Savvy New Canadians

Taxable Income What Is Taxable Income Tax Foundation

What Are Itemized Deductions And Who Claims Them Tax Policy Center

Ey Tax Alert 2022 No 27 Ontario Budget 2022 23 Ey Canada

New 2021 Irs Income Tax Brackets And Phaseouts

New 2022 Irs Income Tax Brackets And Phaseouts For Education Tax Breaks

Us New York Implements New Tax Rates Kpmg Global

China Annual One Off Bonus What Is The Income Tax Policy Change

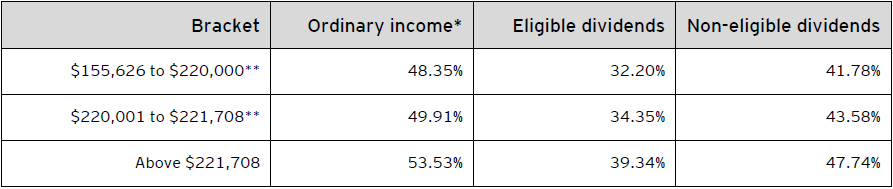

Taxation Of Investment Income Within A Corporation Manulife Investment Management

Income Tax Tables In The Philippines 2022 Pinoy Money Talk

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More